Resources

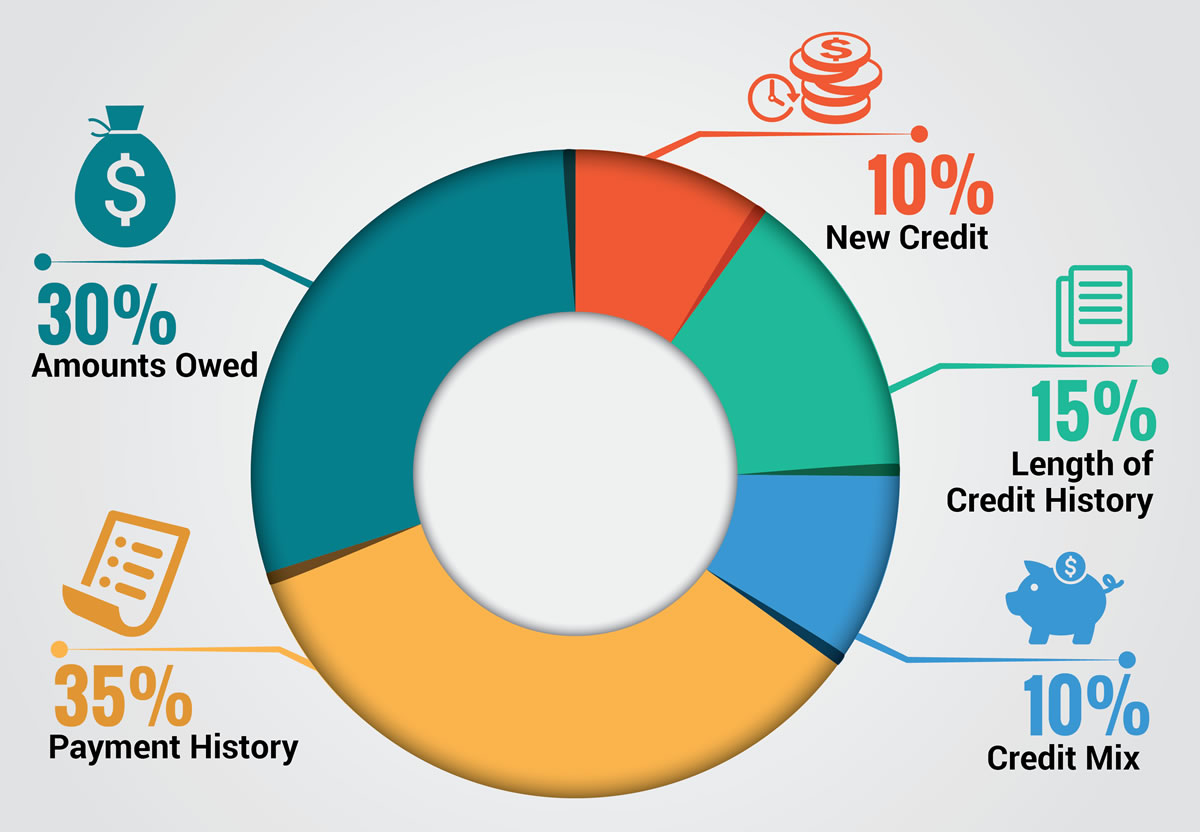

How Is Your Credit Calculated?

It’s important to understand exactly what makes up a credit score and how you can manage these factors to maintain good credit and make wise financial decisions. The chart below shows the breakdown of a credit score.

Frequently Asked Questions

How Long Will This Take?

The average time to achieve desired results is 6 months, but each case is unique. To gain a better understanding, check out Our Process

How Does It Work?

Read through Our Process

Can’t I Do This Myself?

While it is possible for consumers to work through this process themselves, they often aren’t successful in achieving the same results we see. The experience of our qualified staff is the reason credit repair agencies exist. We know how to get the results you need. Further, our unique software fully analyzes your credit history to ensure we identify every last item which may be negatively affecting your score.

Don’t I Need a Lawyer For Credit Repair?

No. While some of our competitors may lead you to believe that they’ll achieve better results because they have lawyers on staff this simply is not the case. There is no significant advantage to having a lawyer on your side when repairing your credit.

Is Credit Repair legal?

Yes. In short, we rely on the Fair Credit Reporting Act (FCRA) as the basis for our disputes with the credit bureaus. The FCRA outlines the rights consumers have in regard to their credit. This includes the dispute process and length of time an items may show up on your report.

Am I Locked In For 6 Months?

No. You have the opportunity to leave the program at any time. We caution that it does require patience on the client’s part to see results, but give it at least 3 months to begin seeing some changes.

How does your Satisfaction Guarantee work?

In short, if you are not satisfied with our efforts we will refund your money in accordance with our Satisfaction Guaranteed Policy. Learn more by downloading and reading a sample of our Client Contract

Are the deleted items gone forever?

Generally, yes. However, as outlined in the Fair Credit Reporting Act (FCRA), credit bureaus have a limited window of time to reply. If they do not reply, the disputed item must be deleted. Occasionally this deletion may be temporary until the bureaus get caught up on paperwork at which time a deleted item may re-appear. If this occurs, please contact your Elevate team member to discuss a course of action.

Sample Contract

Sample Contract

Click the icon to download our Sample Contract